One of the most important reports that come out each month is the Consumer Price Index. The consumer price index is a measure of inflation. Inflation is the sustained increase in the general price level of goods and services. It is measured as the percentage change in the consumer price index over time. Central banks and governments use the CPI to monitor inflation and to set monetary and fiscal policies.

The cost of goods has increased for quite some time now. Some of it has to do with supply chain issues, but most of it has to do with over excessive printing of money. I wanted to create a tracker for us at Signify so that we can monitor inflation and track it during these turbulent times. A lot of us are living paycheck to paycheck and if inflation continues to go up and Fed will continue to take measures to get inflation under control.

According to an article by CNBC, “58% of Americans are living paycheck to paycheck after inflation spike. Including 30% of those earning $250,000 or more. As of May, 58% of Americans roughly 150 million adults — live paycheck to paycheck, according to a new LendingClub report. That’s down slightly from 61% who reported living paycheck to paycheck in April but up from 54% in May 2021. Even top earners say they are stretched thin, the report found. Of those earning $250,000 or more, 30% are living paycheck to paycheck. (Another recent survey, from consulting firm Willis Towers Watson, estimated 36% of those earning $100,000 or more are living paycheck to paycheck.”

Young professionals who are a part of the middle class are getting squeezed and young professionals who are in the upper middle class who overextended themselves, too are being squeezed financially. One of the first steps we can do to take control of our finances is to budget and pay down high-interest debt. Most of us that are in credit card debt.

Inflation began rising in March 2021. In March started to see a significant jump from 1.7 percent in February to 2.6 percent. During this period the media mentioned the increase but moved on to the other topics they had on their programs. However, in April 2021 we saw another significant jump, this time from 2.6 percent in March to 4.2 percent in April. It was around this time that many financial institutions pushed the concerned button. On April 15, 2021, there were articles talking about the supply chain issues and how they may cause economic woes as we go on. Here’s an article from CNBC on April 15th, 2021 “Supply chain slowdown hits at key pillars of the economy and will likely get worse: Dan Yergin.” In this Article, Dan Yergin shared some concerns about the supply chain issues and several other issues that could become a hurdle for our economy. She writes “The most recent IHS Markit global survey of manufacturers finds that the “stretching of supply chains” over the last year has extended delivery times to levels “unsurpassed in over 20 years of data availability.”

With stimulus dollars flowing, the pressures will increase as consumers come out of lockdowns with pent-up demand as well as a lot of liquidity — the household savings rate is now 18 percent compared to the normal 7 percent. The massive container ships – about 5,400 altogether – ply the oceans, carrying to the world’s markets at any given time about 20 million containers, filled with everything from tennis shoes and anti-virus masks to laptop computers, auto parts, and solar panels. Asia is the source of much of the goods, most notably China, home to seven of the 10 largest container ports in the world. The turmoil in shipping began early in 2020 when the pandemic shut China down for two months. That meant the evaporation of expected shipments of goods to the rest of the world. As China recovered, North America and Europe shut down.

She also mentioned “The second major disruption is of computer chips, which is hitting the auto industry. This is made worse by the tangle in shipping. But the main reason is the surge in competing demand for computer chips for electronics and the 5G and automobile industry, along with the overall rapid recovery in China. Then, as things happen, a major computer chip factory in Japan caught fire. An extended drought in Taiwan, a source of 60 percent of the world’s chips by value, has created another crick in the supply chains, this is for the pure water necessary for chip manufacture. The “chip famine” continues to play havoc with auto manufacturing. Today’s cars are also electronic devices that run on computer chips – and increasingly so. Owing to the shortage of chips, the major automakers in North America, Europe, and China have had to temporarily halt some production.”

These were just the tip of the iceberg, and the pandemic was not fully under control at this time. Not to mention it was around this time that jobs because to have discussions about bringing employees back into the office for work. Gas also was climbing during this time as well as food and rent. Inflation stalled out a bit during the months many began to go back to work. Starting in May 2021 we saw a small increase to 5.0, then 5.3 to 5.4 from June to September 2021. Interestingly during this period, there was a bill that was introduced in congress called “H.R.3684 – Infrastructure Investment and Jobs Act”. This was the infrastructure bill that became a huge talking point in the media.

Source: https://www.congress.gov/bill/117th-congress/house-bill/3684

In October 2021 we broke out of the 5.4 percent area and climbed to 6.2 percent. Followed by 6.8 percent in November and in December we got to 7 percent. In November of 2021, Larry Summers began to sound the alarm and shared that the U.S. has a fairly serious inflationary situation. Larry Summers is the 71st Secretary of the Treasury and served from 1999-2001. He warned that inflation was not going to be transitory as Janet Yellen was proclaiming. So, who was right on inflation? What will the Fed do to get inflation under control?

2022

January 2022

Inflation in January rose to 7.5 percent. Around this time many began to murmur about the “r” word. The White House quickly denounced that idea and told everyone that our economy was going fine although the numbers weren’t showing it. On January 26th, 2022, the Fed shared that they would be looking to start raising interest rates in March and mentioned they were considering broader tightening. In a CNBC article Fed Chair Powell shared “I think there’s quite a bit of room to raise interest rates without threatening the labor market,” Powell said at his post-meeting news conference. Also “Fed Chairman Jerome Powell said asset purchases also are likely to halt in March, and the central bank released a paper, outlining principles to start “significantly reducing” the bond holdings on its balance sheet without indicating a specific time frame.” This is very important information because when the Fed talks about increasing interest rates, that also means a lot of businesses will look into balancing their sheets. This might not be good news for the workforce.

Source: Fed decision January 2022: Federal Reserve points to interest rate hike coming in March (cnbc.com)

February and March 2022

Inflation continues to rise in February and March 2022 from 7.9 percent to 8.5 percent. Stocks are continuing to drop, and Russia decided to move forward and invade Ukraine. In March 2022, oil prices broke highs set since 2008 as a result of the Russia/Ukraine war. Gas prices are climbing, and many are comparing the times to the 1970s. In 1970 there was high inflation, high food prices, and high gas prices. Also, there were gas shortages. In March we also got the GDP advance report, which is negative. If this number stands many will circle July 28th on their calendar. Tow consecutive negative GDP = recession. The Fed in March raised interest rates for the first time in 3 years by 25 basis points.

*Inflation at 8.5%.

April and May 2022

Inflation seems to have been stopped in its tracks. We pulled back to 8.3 percent in April but slightly increased to 8.6 percent in May. The pandemic is still here and the “Great Resignation” is becoming a huge talking point in the media. Folks are leaving their jobs in groves and it’s creating an abundance of jobs. The problem is many don’t want to work the jobs available. On capitol hill, some Republicans are saying that many are leaving the job market and not working due to stimulus money they received from President Joe Biden. Although that could be the case for a small number of Americans, it’s also possible that many are getting burned out due to the extra demand that jobs were requiring. Workers are demanding more pay not just for their hard work but also because of inflation. Gas in some areas in California is over 6.00 per gallon and its possible gas can be over $9.00. With more employees pressuring corporations we might soon see corporations fighting back.

Inflation at 8.6 %

June and July 2022

Well for those who thought this was the peak it was not the peak and inflation is now at 9.1 percent. The fed has increased interest rates by 75 basis points to tame inflation. However, many are wondering if the Fed responded too late. Gas has been going down and the economic reports are…odd. We have strong job numbers, and unemployment is down to 3.5% but the GDP report came out…and well it’s -0.9. Although it’s not the final reading two consecutive negative quarters of GDP = recession. The White House is deciding to change the definition. Press Secretary Karine Jean-Pierre was asked, “Does the President run the risk of looking out of touch at this moment by digging in on this definition that this moment is not a recession if, in fact, at some point, it’s determined that that’s exactly what’s happening?” Mind you this was after the GDP report was released. Press Secretary Karine Jean-Pierre responded

“You know, I have to tell you, Kristen, I don’t think we’re digging in; we’re being asked. You know, we’re being told — and, you know, every day I’ve come in here, I’ve been asked, “So, Karine, what — you know, is this a recession?” So, we’re answering the question. We’re — we’re using the facts to answer the question. We’re using economists who have said, “Hey, this — this…” —

For example, Chair — Chair Powell says, “I do not think the U.S. is currently in a recession. There are just too many areas in the economy that are performing well.” And that matters as well, as we are trying to explain to the American people.”

We need to put a pin on July 28th, 2022, for future reference. Yes, job reports look strong however companies are beginning to lay off employees. Check out this article by Business Insider that describes what’s happening currently “A wave of layoffs is sweeping the US. Here are firms that have announced cuts so far, from Shopify to Tesla.” In this article we see the number of layoffs recorded or planned Shopify: About 1,000 workers, 7-Eleven: 880 jobs, Vimeo: 6% of its workforce, Tesla: 229 employees, Rivian: Potentially around 5% of its workforce, GoPuff: 10% of its staff, Re/Max: 17% of its workforce, Microsoft: Less than 1% of employees, JPMorgan: Over 1,000 workers, Compass: 450 employees, Redfin: About 6% of total employees, Coinbase: About 18% of its workforce, Carvana: About 2,500 people, Reef: About 750 people, Better: About 4,000 people, Noom: 495 people, Peloton: Over 2,800 people, Thrasio: Up to 20% of staff, sources say, Robinhood: More than 300 people, Wells Fargo: Unknown number of people in mortgage lending, Canopy Growth: 250 people. This is only the beginning of businesses continuing to balance their sheets.

Source: Layoffs Sweeping the US: Shopify, Coinbase Making Cuts (businessinsider.com)

Inflation at 9.1%

August and September 2022

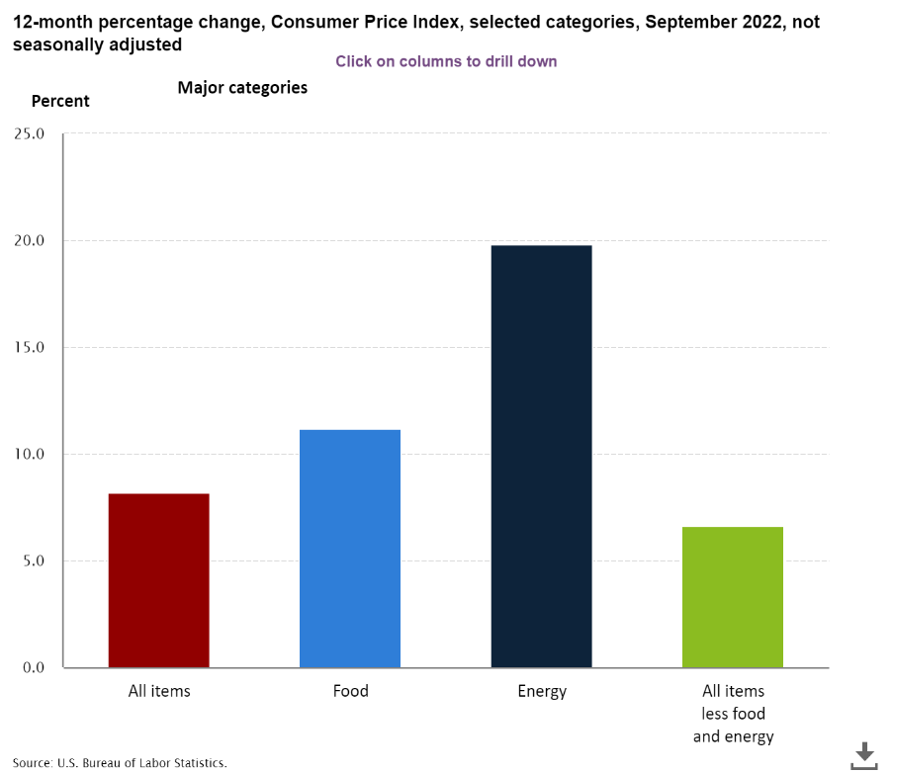

Inflation is still over 8 percent, and a lot of CEOs mention a recession is approaching. For august inflation was 8.3 percent and was 8.2 percent in September. The Fed has mentioned that it will continue to raise interest rates and will continue to slow the growth of the economy. So far the fed has increased interest rates by 150 basis points since June. Jobs are beginning to lay off employees as they look to balance their sheets. The national average for gas is around $4.00 a gallon, which is better than it was earlier in the year, and energy cost is slightly lower but is still relatively higher than normal.

The heat waves across the country are showing us the vulnerabilities of our energy grid and it’s going to cost us eventually. In California residents were asked to use less power to assist in lowering the energy demand. Not to mention lakes are drying up and water conservation is becoming more common. Energy is going to become more expensive not just due to the heat and soon-to-be cooler temperatures in the next 2-3 months, but also because of the energy crises across the globe. Here is a chart of how we fared in September.

Source: https://www.bls.gov/news.release/cpi.nr0.htm

Inflation at 8.2%

October 2022

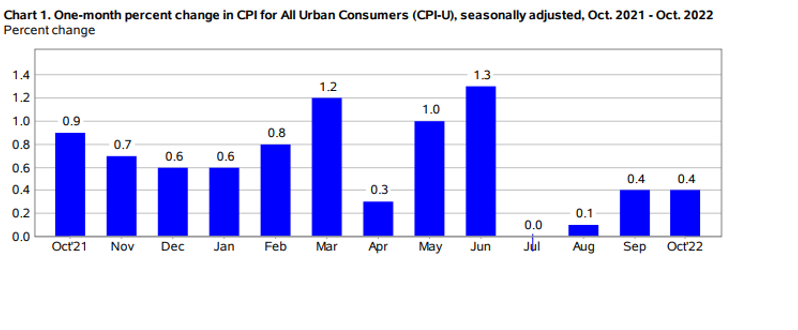

Inflation is now under 8 percent! For the month of October, we are at 7.7%. We are not out of the woods just yet. Inflation is still high by historical standards and many American continue to feel the effects. Here’s a look at the consumer price index by months starting October 2021-October 2022.

Source: Consumer Price Index – October 2022 (bls.gov)

One of the biggest issues Americans shared during the midterms was the state of our economy. Fed chair Powell reiterated that he will not take his foot off the pedal increasing interest rates. Fed Chair Jerome Powell said earlier this month that the central bank still has “some ways to go” in its battle to tame inflation, sentiment is increasing that the Fed may be able to tap the brakes, but it’s just wishful thinking.

Inflation at 7.7 %